Accounting is the cornerstone of managing financial activities for any business. At its core, it involves tasks such as recording, categorising and analysing financial transactions to glean valuable insights into a company’s financial health. This information is then used to prepare financial statements, make business decisions, remain compliant or simply be as transparent as possible with stakeholders.

Accounting: Definition and purpose

Accounting is the systematic process of tracking a business’s financial activities, including income, expenses, assets and liabilities. These activities are summarized into financial statements – e.g. an income statement, balance sheet or cash flow statement – to give a clearer picture of a company’s financial position.

Accounting data helps businesses understand their cash flow, profitability and overall stability. Moreover, it can support big business decisions, as accurate financial records can help inform decisions about staffing, inventory, investments and expansion plans. It’s also helpful for staying compliant – accurate and timely records mean a business is better able to adhere to tax laws, regulatory requirements and Generally Accepted Accounting Principles (GAAP) or Australian Accounting Standards (AAS).

Accounting process explained

The financial accounting process comprises several steps, including but not limited to:

- Recording transactions: All financial transactions (sales, purchases, tax payments, etc.) are kept in accounting records.

- Categorising entries: Transactions are classified into accounts like accounts payable, accounts receivable and expenses.

- Preparing financial statements: Data is compiled into reports like income statements and balance sheets to summarise a business’s financial performance.

- Analysing financial data: Insights from financial reports can help to inform business strategies and operational decision-making.

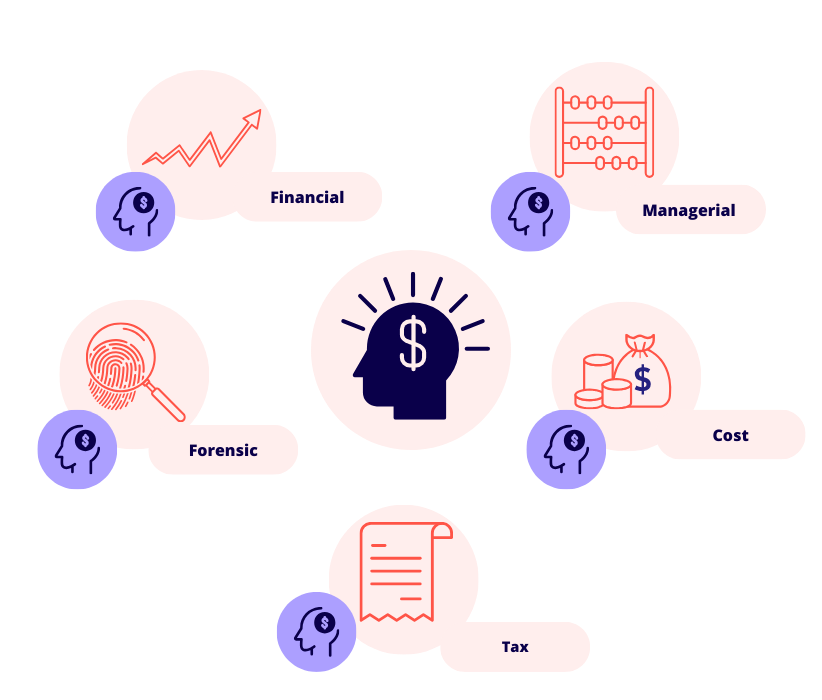

Types of accounting

There are different accounting practices that serve different purposes, depending on the needs of the business. Some of the most common types are:

1. Financial accounting

This is all about preparing external financial reports that present a company’s performance to investors, creditors or stakeholders. Publicly traded companies need to follow accounting standards so that they are always transparent in their operations.

2. Managerial accounting

Also known as management accounting, this type supports internal decision-making by analysing costs and budgets and forecasts. It can be helpful for managers who are planning operations or wanting to optimise their resource allocation process.

3. Cost accounting

As a subset of managerial accounting, cost accounting tracks the expenses involved in producing goods or services, with this data then being used to inform pricing strategies and any potential improvement strategies.

4. Tax accounting

Governed by the Australian Taxation Office (ATO), tax accounting is all about getting businesses to meet their tax obligations while at the same time managing their deductions and planning for future liabilities.

5. Forensic accounting

Forensic accounting investigates financial discrepancies, often for legal purposes, such as detecting fraud.

Financial statements

Accounting is how you create a number of important financial documents for a business, including but not limited to their:

- Income statement: Shows revenue, expenses and net profit or loss during a specific accounting period.

- Balance sheet: Gives a snapshot of a company’s assets, liabilities and equity at a specific point in time.

- Cash flow statement: Tracks the movement of money in and out of the business.

The role of accounting professionals

Accounting professionals – from bookkeepers to certified practising accountants (CPAs), who might also sometimes be known as a certified public accountant – handle a number of different accounting tasks, such as:

- Recording financial transactions.

- Preparing financial statements.

- Giving advice and lodging tax returns.

- Helping businesses stay compliant with accounting standards and regulations.

For small businesses, using accounting software can help automate routine but time-consuming tasks like invoicing, bank reconciliations and financial reporting. However, professional accountants are invaluable for more complex functions like tax planning.

Accounting for small businesses

Small businesses have to juggle a variety of challenges in regard to managing their business and personal finances. Here are some useful practices to help simplify accounting:

- Set up a business bank account: Separating business and personal transactions makes for clean records and simplifies tax matters.

- Use accounting software: Accounting platforms can streamline data entry and reporting, thereby eliminating manual errors.

- Keep accurate records: Consistently record financial transactions to avoid any potential discrepancies.

- Seek professional help: Engage a CPA for the most accurate financial statements and compliance with accounting standards.

Accounting is much more than just crunching numbers – it’s about understanding and leveraging financial data to make smarter business decisions and drive long-term growth.