Credit is when you borrow money or funds and pay it back later or over time with interest.

Credit is also a standard tool lending institutions use to assess borrowers’ financial soundness. It is commonly referred to as a credit report or credit score.

Credit in lending and borrowing money

Credit is a financial tool used by individuals and businesses to finance or pay for goods or services. When it comes to lending and borrowing money, there are two parties: the lender (creditor) and the borrower (debtor).

There are different types of money lenders, but the most common are banks.

Types of credit

A financial institution or other money lender will offer various types of credit for their customers.

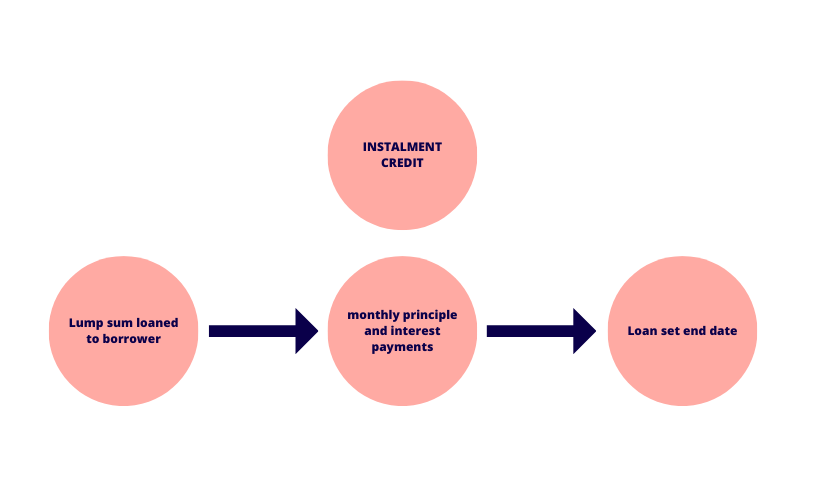

Instalment credit agreement

An instalment type of credit is typically an agreement between the creditor and debtor to borrow a lump sum and repay the total amount plus interest in small increments over a set period.

For this type of credit, immediate payment is unnecessary, and lenders will have a specific contractual agreement laying out repayment terms for borrowers at a future date.

Most instalment credit agreements are loans, such as business loans or personal loans. The bank or lender sets the terms and interest rates for each.

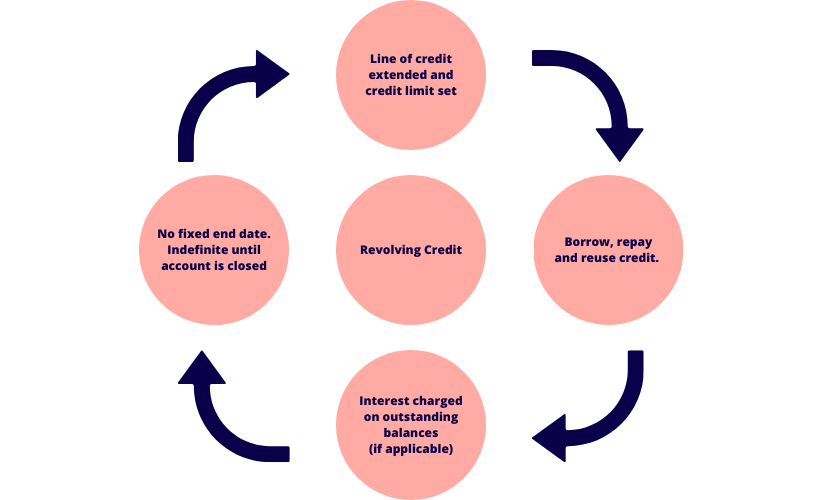

Revolving credit

Revolving credit is a type of credit in which a borrower opens an account with a credit limit. This credit limit resets after a period, meaning a borrower can use up to the credit limit and continue to do so indefinitely as long as repayments and interest charges are made.

An example of revolving credit is a credit card. A credit card company will provide the borrower with a line of credit, which they can use to pay up to a certain amount and continue to use the account as repayments are made.

Other types of credit

Other types of credit focus on consumer credit reports and credit scores. To see how responsible you are as a borrower, lenders use these to evaluate your history of making payments, whether on credit cards or utility bills.

Credit report

A credit report is a financial record lenders use to view a customer’s credit history. The report lists various personal details of a customer and accounts for their current and past credit payment history. Lenders use this document to make an informed decision about whether to extend credit.

Credit score

A credit score is given to individuals and businesses to inform lenders of their ability to repay debt. It ranges from 0 to 1200 (depending on the credit reporting body) and can change within an individual or business’s life cycle.

Lenders will view an individual or business’s credit score and may provide services based on whether they have a strong credit history or a credit risk. Higher credit scores are predicated on several factors.

Examples of excellent credit may include:

- Successfully met current and past repayments

- A low and infrequent number of loans

- No history of defaulting on repayments

Examples of poor credit may include:

- Late or deferred payments

- Past bankruptcies

- Frequent and high number of loans

- Outstanding debt

Good credit habits are beneficial, as a history of bad credit will impact your capacity to borrow funds and run your small business.

See related terms

What is debit?

What is cash flow?

What is capital?